Our world is becoming progressively more digital, and today’s customers and trading partners are increasingly comfortable using new technologies. In fact, they expect these digital experiences in every interaction. This means that the future of insurance needs to become much more digital. Insurers can either prosper by becoming digital insurers or continue along the same path and watch their customers and business partners migrate to companies that offer more innovative products and services that better suit their needs.

In a highly competitive industry that is not traditionally known for innovation, changes in demographics, technology, channels and business models are creating significant new opportunities for insurance companies to defend market share and increase revenue and margins. The need to innovate, and to do so quickly, is now deemed critically important by 88 percent of insurance companies. But innovation can come in different forms.

The “uberisation” myth: how adjacent innovation is a winning strategy

Many companies are obsessed with coming up with the next Uber for their industry. For that reason, they’re overly focused on disruptive innovations, meaning new products or services that completely upend existing markets or create entirely new ones. Like Uber, Netflix or Airbnb.

But it is not always necessary to come up with a grandiose silver bullet idea in order to innovate. In fact, these kinds of projects are high risk and have a low chance of success. This means that these projects are often dreamed about and debated internally, but may never actually get off the ground.

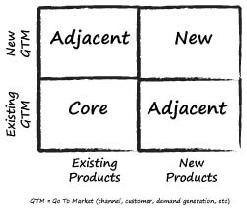

While insurers should test disruptive ideas, they can also deliver business value quickly by focusing on adjacent product innovation. Simply put, adjacent innovation includes taking existing products into new markets and digital channels or creating new digital products for existing markets.

New channels can help insurers sell products in new ways that better resonate with customer preferences and behaviour, and new customer segments can help reshape an existing product to create a new offering.

The Benefits of Adjacent Innovation

Adjacent innovations keep one area stable, like the product or service, while focusing on creating a new and innovative go-to-market opportunities. By minimising the number of completely new products, insurers can focus on creating value in one area by leveraging existing assets.

Adjacent innovations also tend to scale faster because you are not creating everything from scratch, meaning it is a low-risk, high-value innovation. This allows you to rapidly create a minimum viable product (MVP) that shows quick impact and value that executives will want to champion. This type of innovation will ultimately change the culture of your organisation for future innovation projects. The sooner you can show value and generate internal PR and executive buy-in, the quicker you can scale.

Adjacent innovation in action

There are many insurers who are already practicing adjacent insurance innovation to deliver business value. One such firm in the US that is taking their existing products into a new channel is a specialty insurance company that wished to implement a new model allowing them sell directly to the end customer.

By disintermediating, this insurer was able offer products at a lower, more competitive price because the cost of sales decreased. This had the impact of improving margins in a short period of time. This particular insurer operates a high transactional model, so they created a multi-channel solution that is self-service and fast. The application, which is for casualty lines, allows policyholders to get quotes, then buy and manage their policy without needing to interact with the carrier. This flexible, automated solution supports the new business model of selling directly to customers, with the advantage of being able to offer lower pricing than had previously been the case. That is not to say that brokers do not bring real benefit to the business transaction or relationship, but simply demonstrates the value technology can play in simplifying the processes.

Another innovative insurance company wished to create a new version of their life insurance product to make it more simple, accessible and transactional, enabling the customer to easily get a quote online and buy the product. With the launch of new propositions into the market, the group maintained its competitive advantage while also increasing premium volumes through more targeted products. A small team delivered the products in a matter of weeks versus the typical 4 months in IT development time. Their iterative releases also led to more frequent market feedback earlier in the go-live schedule, allowing the team to hone their product portfolio with additional releases.

Key Takeaways

The important thing is for brokers and underwriters to have a properly balanced innovation portfolio. Alongside experimenting with transformational ideas, think about processes to support rapid time to market for adjacent product innovations. Your process for digital innovation should be all about speed, agility and low cost. Fostering a culture that supports a test-and-learn, fail-fast approach will get new ideas into the market quickly and at a lower cost.

Download this eBook to learn the 5 steps to Insurance product innovation

David Kuhn - Insurance Solutions Director at Mendix

David Kuhn is an experienced business and IT leader who has a demonstrated history of growing revenue and reducing expenses by creating, thoughtful, industry leading solutions for the insurance market. David previously held the position of Chief Architect of Erie Insurance where he implemented Mendix to address the changing insurance landscape, using the platform to deliver applications to keep pace with competition, improve efficiency and ensure their agents better serve customers.