While the insurance sector has taken longer to transition to a digital and data-driven era, the advantages of enhanced efficiency and deeper customer understanding suggest that this transition is becoming more urgent.

One of the main insights in the report "Digital Modernisation in the Insurance Industry: How to Drive Progress in Your Organisation", produced by EPAM in collaboration with London Research, is that insurance companies are gradually realising the necessity of change. The findings indicate that less than half of the organisations surveyed regarded themselves as 'advanced' in terms of business transformation, with a marginally greater percentage observing 'substantial' progress.

The need for complete business transformation or operational restructuring has not been pressing until recently. However, unique and shared challenges across industries are now necessitating change in the insurance sector.

Navigating Legacy Technology

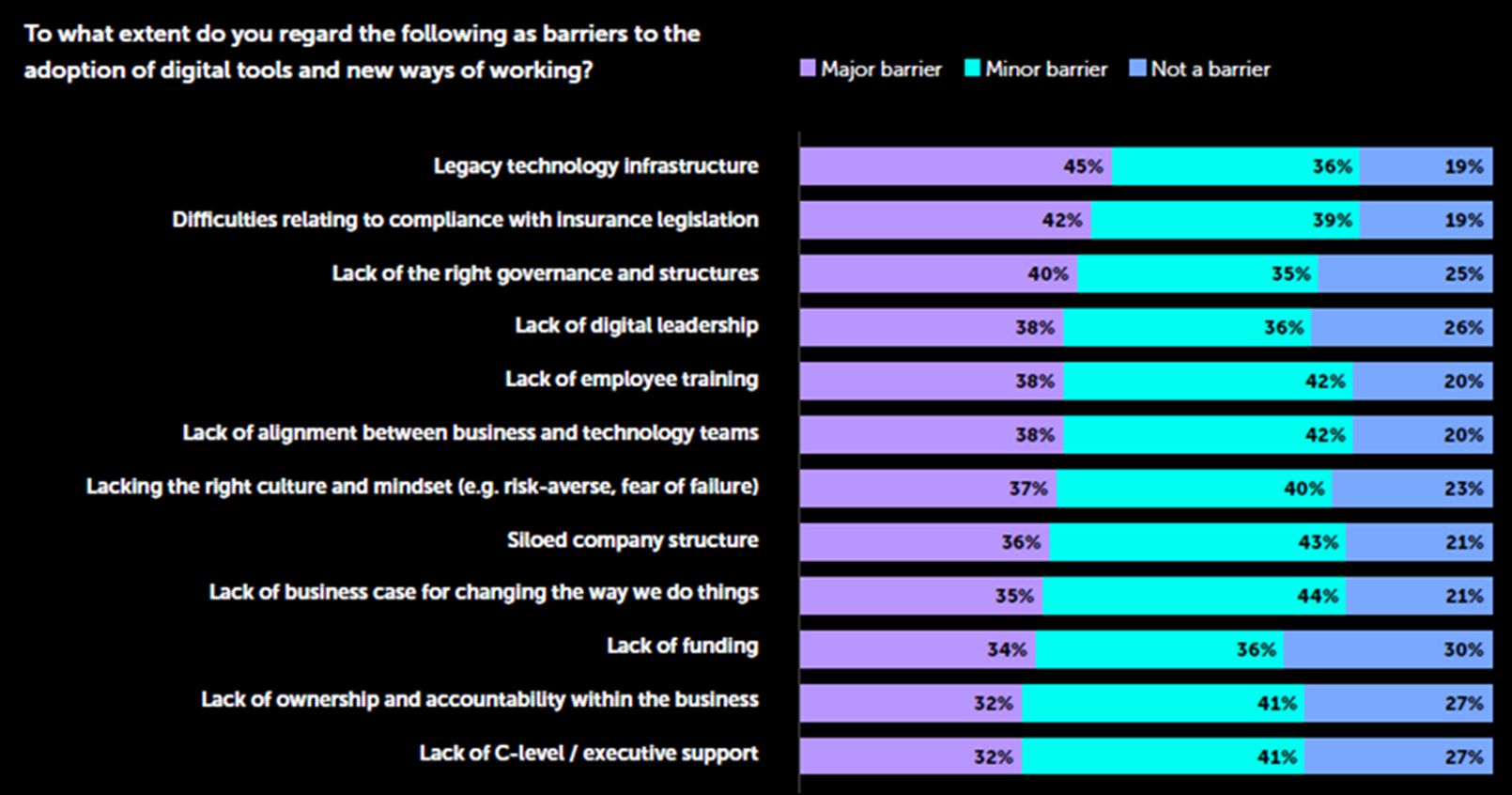

Legacy technology infrastructure is the prominent obstacle in the way of digital adoption and new working methods for insurance companies, as identified by 45% of businesses surveyed. This issue hinders innovation, impacts internal and external experiences, slows down speed-to-market, and strains IT teams maintaining and upgrading it. Moreover, makeshift solutions implemented by frustrated staff amplify future potential issues for IT departments.

Other factors compounding the legacy tech problem include a lack of digital leadership (cited as a major problem by 38%), lack of alignment between business and IT (38%), lack of a business case for changing the way things are done (35%), lack of funding (34%), and lack of executive support (32%).

AI is Transforming Industries – Are Insurers Prepared to Embrace It?

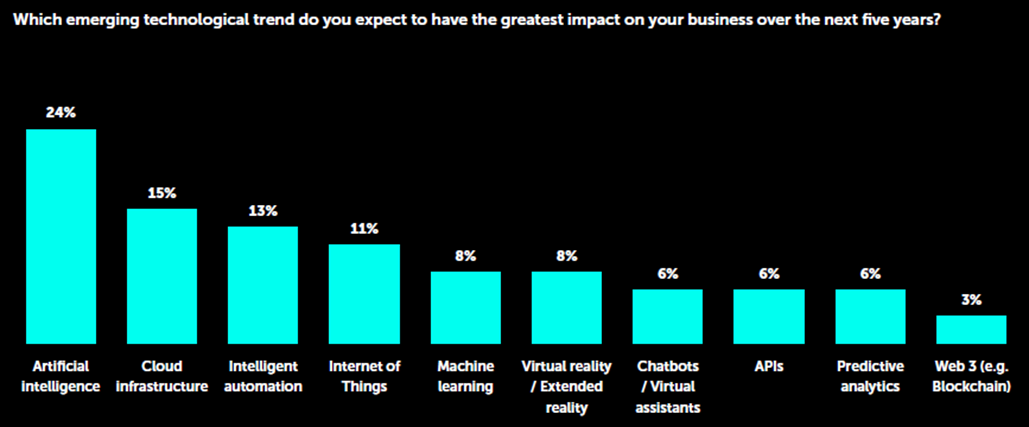

As per the survey, 57% of respondents acknowledge that recent AI and machine learning developments are set to notably influence their business, with 24% foreseeing it as the most impactful factor in the next five years.

In commercial insurance, AI can enhance auto-follow and auto-lead opportunities, providing underwriters with expedited data navigation, prioritised data points, and recommendations. However, implementing these advanced capabilities only begins with appropriate access to business data and necessary infrastructure support.

Technological Advancement: Recognised but Underfunded

The survey implies an industry that, at the executive level, acknowledges the need for greater technology integration but has been slow in aligning the funding to realise this transformation. Unless major disruptive legacy replacement is undertaken, the substantial value-addition that technology can offer may continue to be underestimated, thereby limiting technological investment.

As AXA's CIO, Natasha Davydova, mentions in the report, the economic value of IT extends beyond mere cost reduction – it enhances overall competitiveness, customer appeal, data transparency, and value creation through technology.

Charting the Path Ahead

As insurance firms continue to plan their future course, the urgency for digital transformation within the industry is reinforced. The road ahead demands creativity, a service-centric approach, and a robust, forward-looking technological infrastructure. Not just incremental enhancements, digital transformation brings about an overhaul of the entire operational model – enabling easier flow of data, actions, and insights across the organisation.

To successfully navigate this shift, insurance companies must embrace new technologies and foster a culture of continuous learning and adaptability to the dynamic digital landscape. Integrating AI and machine learning into insurance processes has begun to show potential but must be leveraged more effectively to fulfil future possibilities.

The complete report – "Digital Modernisation in the Insurance Industry: How to Drive Progress in Your Organisation" – produced by EPAM with London Research is available for download here.

Stephen brings over two decades of transformative IT leadership to the forefront of insurance technology. At EPAM, he's driving strategic change for our clients, blending 25 years of expertise with a digital-first engineering mindset with deep insights into the insurance sector. His highlights includes roles as a Global Program Director at QBE and CTO at Lloyd's of London, where he helped lead major digital modernization initiatives. Fuelled by a passion for improving insurance businesses, Stephen excels in leveraging cutting-edge technology to make the market more adaptable, data-fluid, and client-focused.

.png)