Start-ups are often theorised as important players in the innovation ecosystem across the Professional Services. However, not all start-ups and economic ecosystems are equal in that regard. When we focus on transformation in insurance through the possibilities of Artificial Intelligence, only a subset of start-ups has the potential to be truly transformational to the whole sector. This white paper is a quantitative assessment of start-ups data to map the business landscape in terms of their position in the AI transformation of insurance. We particularly analyse which technology combinations produce clusters of insurance classes and business models. We also probed globally looking at where the places for new combinations of knowledge are likely to occur in the AI transformation in this industry.

Diverting from the traditional knowledge production indicators

Historically, knowledge production has been primarily studied quantitatively using available databases, commonly based on patents, bibliometrics (scientific publications), R&D Expenditure, governmental bureaus, business and innovation surveys. However, as the pace of innovation accelerates, it is increasingly difficult to stay on top of the latest developments using these traditional sources, as they are not only less relevant to proxy innovation in insurance, but also, they are manually customised to the industry and scientific community developments, in intervals of years, making those indicators less relevant to follow the fast-technological changes.

What is knowledge-space?

The idea of a knowledge and technologies mapping exercise for different industries, is quite common however, the notion of relatedness of knowledge and technology is hard-coded into the taxonomy of industries and technologies: The standard industry classification (SIC), and patents data, respectively. Although the SIC-type taxonomies have been commonly used to construct indicators of a variety of technologies co-occurrence, it is commonly derived from patent classifications, generating a network diagram labelled as 'industry space', 'skills space' or 'knowledge-space'. Those hard classifications that are manually being updated are quite limited in terms of representation of the Advanced Professional Sector as a whole and in particular the insurance industry. Hence, we decided to avoid companies with their affiliated SIC classifications and patents, as a unit of analysis, and rely on an alternative real time data source that is more dynamic and less bound to historically-grown classifications. The emergence of such real-time large-N firm databases, using user-generated technology classification, provides an alternative source to overcome these classification issues.

The fast-moving knowledge industries, and the growing investment in start-ups in general, fostered a private sector initiative to develop new types of data collection, mostly by harvesting the web, collating all available information about knowledge creation tagged into categories. Those categories are indicators of technological knowledge. Technological knowledge measurements can be used to identify regional strengths, clusters of knowledge, specializations, co-classification, knowledge flow, technology convergence and even the absorptive capacity, a term that was coined in the 1990’s to describe how to know what we don’t know. In this white paper we investigated the insurance global knowledge-space.

Mapping the knowledge-space around the digital transformation in Insurance, through creating a network of knowledge classifications that are provided by start-ups, is the key objective of this work. As soon as one knows how the knowledge-space is composed, and where the knowledge-space is evolving towards, it becomes possible to predict which regions might be best positioned to thrive from a technological transformation.

Generating the insurance knowledge-space map shows us which related technologies drive which kind of innovation in the insurance sector. By coupling these insights to the geography, a picture is generated about the forces that drive the next generation insurance. Hence in this work with the near real-time data, we were able to answer the following two questions:

Question 1: What does the InsurTech start-up landscape look like in terms of related and unrelated variety in technologies?

How to read knowledge-space graph

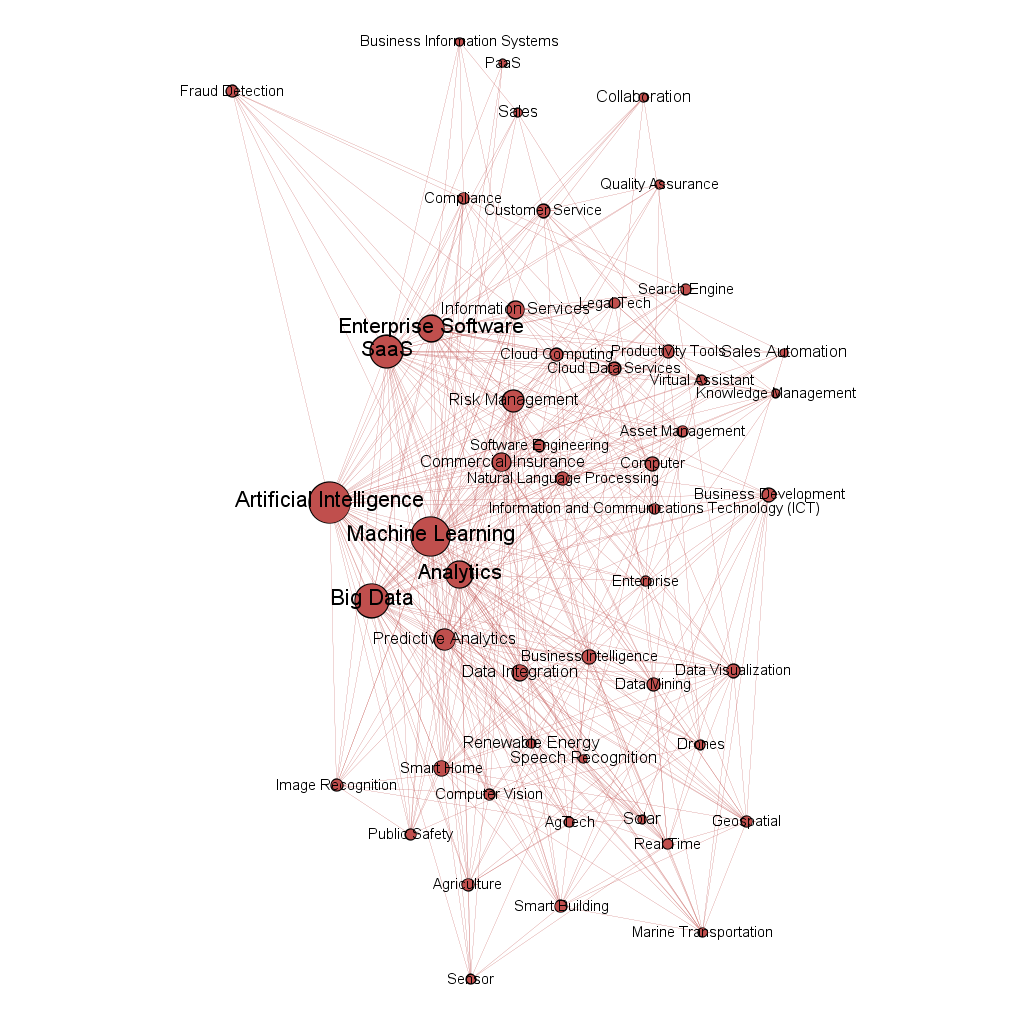

The knowledge-space graph is composed of nodes and edges. The ‘nodes’ (the circles) represents technological categories, as well as application sector categories, such as, "Artificial Intelligence", "Machine Learning", "Health Care", "Finance", "Saas", 'Internet of Things", and "Big Data". The ‘edges’ are the lines that represent the ties that connect the nodes.Each company in our dataset has a set of ‘tags’ or categories of knowledge. In order to create a knowledge space from our start-ups database, we need to transform our data in such a way that a category becomes a node in a network, while the tie between these nodes shows how proximate these categories are to one another. Filtering the most significant clusters of nodes with a high probability to coalesce, as seen above in figure 1, the five most significant InsurTech clusters.

The result is that the visual layout in the graph becomes a representation of relative cognitive distance in knowledge space. The network was built on a dataset of 2,810 global start-up companies, tagged with 382 different categories/ nodes.

Our findings suggest that AI-related technologies are the heart of the digital transformation on the insurance industry (see the magnified view into the related technologies of AI in figure 2). We also found a cluster of Finance and Banking; this means that there are tech companies that distinctively identify themselves working in both markets. We assume that these are companies that offer General Purpose Technologies (GPT) that are transferable between those two industries, a good example could be RegTech companies. A similar observation is related to the PropTech cluster – a shared combination of tech solutions for property asset class and the property industry. We also found a distinct cluster for health insurance, (more about this cluster with its unique geographical characterisation in the following section). Lastly, IoT is closely related to Auto insurance (rather than any other cluster), this shows the growing reliance on telematics to customise and innovate in this asset class .

Question 2: What is the geographical distribution of distinct knowledge fields in InsurTech start-ups and financial centres?

Aggregating the knowledge to the scale of cities, regions, or countries allowed us to understand the start-up population of entrepreneurial ecosystems. The same analysis also allowed us to compare different global tech-hubs with respect to their degree of InsurTech specialization.

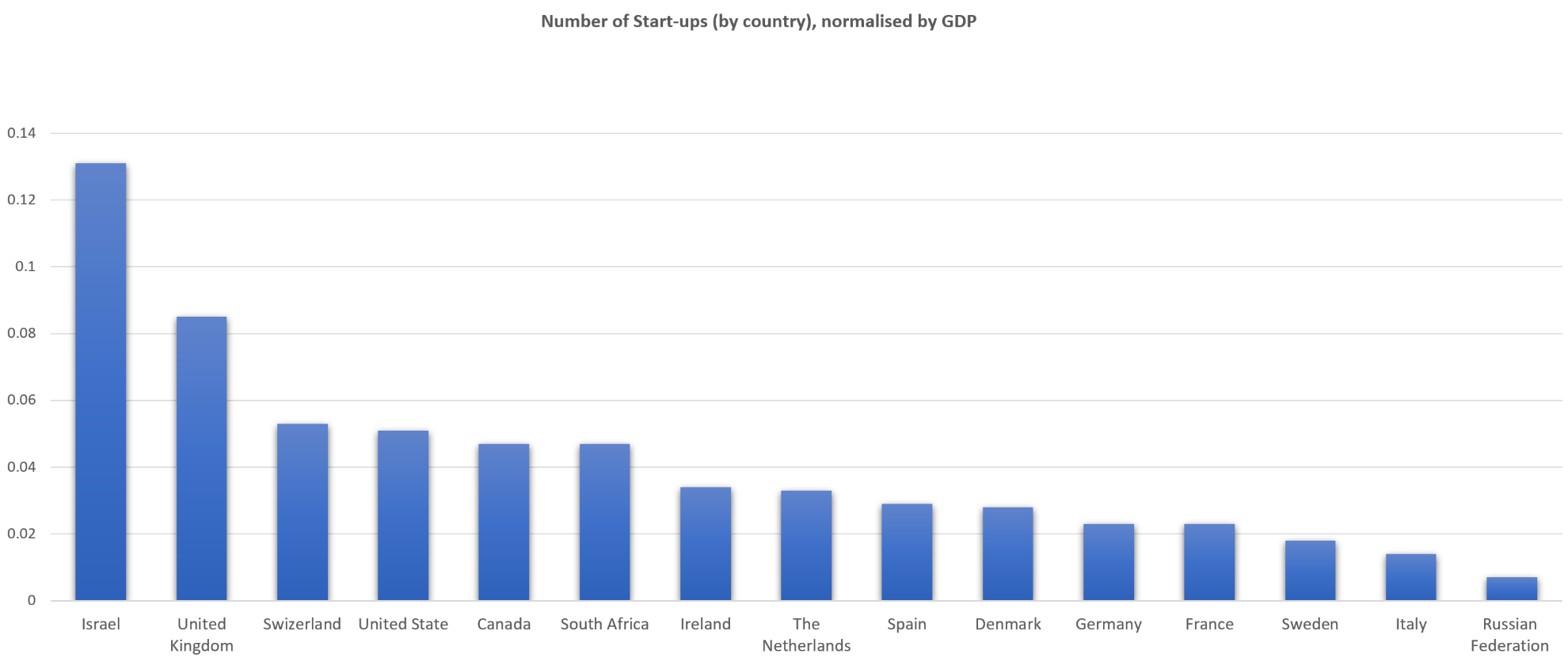

In our dataset, the start-ups are spread across 411 metropolitan areas, 163 of which are in Europe, in a total of 84 countries. The USA leads with 1,041 start-ups with the UK trailing second with 243. Figure 3 weights these raw numbers through normalizing them with GDP. Note that we excluded Asian and South American countries from the comparison due to suspected bias in the dataset. Figure 3 shows that normalized for GDP, Israel is by far the most active player in the InsurTech field, with the UK following rapidly.

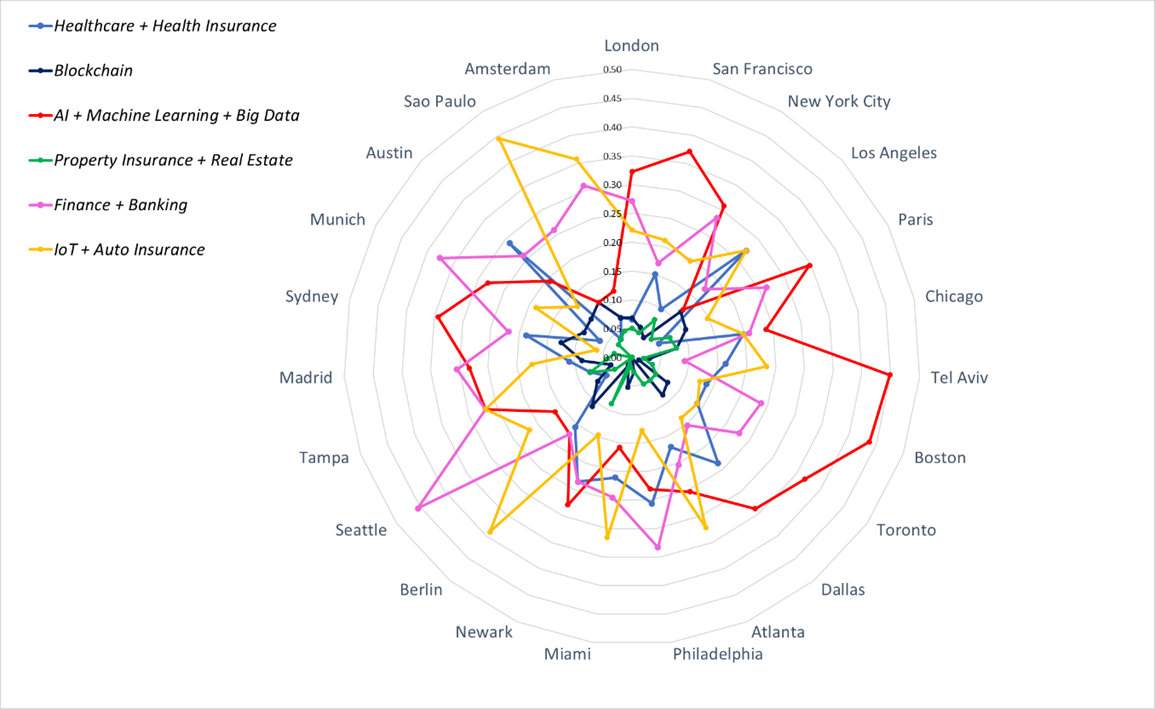

Based on the 5 identified insurtech clusters above, we looked at the top 23 cities that were most prominent in the dataset in the world, and tried to map their specialisations, (normalised to the cluster). A star graph allowed us to compare between cities particular knowledge-space clusters.

In figure 4 we can see how fundamental the AI-related technologies cluster is for many leading insurtech cities. In particular in San Francisco, Tel Aviv and Boston. We can also clearly see how Healthcare and Health insurance is thriving in many American cities but not in London. We attribute this to the market pull, as American cities heavily rely on private insurance, compared to the UK Public Health Service where the need to proxy risk by the private sector is less due to government provided health cover.

Key Suggestions for Policy Advice

- A shift from ‘industries’ view to ‘knowledge-space’ view. We recommend for policy makers to consider shifting perspective from focusing on a policy to stimulate specific industries, to knowledge-space and skillsets that are transferable between industries. Today’s tech can diversify across markets, due to the technology and needs being shared across industries. Specifically, we call for new types of funding to be less about distinct industries and more about the set of the identified knowledge clusters to leverage on the strengths that are evident geographically.

- Closing the Knowledge-space gap between investors and companies. Policy makers need to understand the gap between investors' location and expertise, versus the InsurTech companies’ knowledge-space and their location. In order to ‘bring the money’ closer to fund new ventures, we recommend stimulating investors (with risk sharing) to increase their portfolio in the areas that we identified in this work. We specifically recommend planning for a few years of a joint funding programme to start the momentum and expand the local funding opportunities.

- Cross-industries knowledge flow. In order to expand and stimulate a specific industry, such as InsurTech, the government should encourage and support cross-industry knowledge flow, allowing opportunities for companies that provide technological solutions in one industry to find opportunities in other industries. This cross-industry approach can expand the business proposition, increase streams of revenue for the tech companies, develop new stream-line channels and expand innovation opportunities for incumbents.

- Globalisation power - UK strength. Each knowledge-space should be benchmarked with other InsurTech strong clusters in other places in the world. To keep those clusters’ competitive advantage there are three elements that will be required: Maintaining and developing the local skills to stimulate the local knowledge-space; Securing and encouraging funding avenues; Providing ‘market making’ network opportunities within the industry and cross industries.

This work was supported by TECHNGI - Technology Driven Next Generation Insurance. I would like to acknowledge Digit Lab funding. Please visit our call for participation in The Digit Lab Business Model Workshop, where we aim to help businesses in their digital transformation.

.png)

Dr Tzameret Rubin is a Senior Lecturer in Innovation and Management, at Oxford Brookes Business School. Starting in the flourishing Israeli high-tech sector, she shifted her career to academia, where she focuses on policy-oriented innovation research. Her interest is in the digital transformation of the advanced professional services sector, in particular, Finance, Insurance, Accountancy and Law. She leads a set of multimillion-pound research projects specifically AI in insurance; TiPS the world first innovation adoption accelerator in the professional services; Digit Lab - accelerating digital innovation of large established organizations, and Open Finance Passport, protecting consumers data.

.png)

.png)