Where did those months go, or was that just me?

If you’re anything like me, you’ll have had moments recently where it’s been difficult to remember what day, week, or month we’re in—such is life in the third national lockdown. Things should get easier as spring arrives, with the weather improving, the days growing longer and, fingers crossed, the pandemic restrictions gradually being lifted.

Lockdown has impacted all of our lives, but not least for those who work in the London Market. The Market has been through the normal madness of the 1/1 renewal season, with some rate increases evident across certain classes of business, plus we’ve had the legal case going on involving the Covid-19 BI claims and the Supreme Court judgement. The big question on everyone’s lips is, what will the Market be like when we return to the streets of EC3? Only time will tell, I guess, but we are starting to see a glimpse of what to expect. Like me, some of you will have taken part in the consultation to discuss the future of the Lloyd’s Underwriting Room, so we’ll see what emerges from that interesting piece of work.

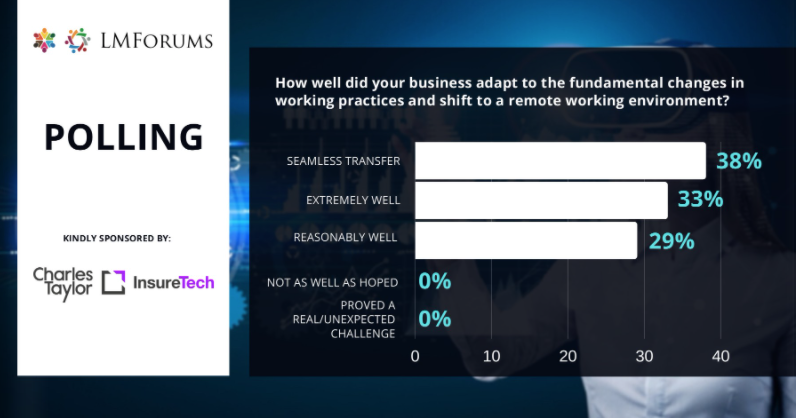

More generally, one of the biggest lockdown challenges for many has been the continuing requirement to work remotely, and the impact that this has had on new business acquisition. We’re a resilient bunch in the Market, and professionals at LMForums virtual gatherings have told us just how well they’ve adjusted to their new trading environment - some have been extraordinarily surprised!

However, understandably, many professionals are keen to see the return of the more conventional face-to-face way of working where they can conduct regular opportune business, albeit supported by the array of digital tools and platforms that have become common place over the last 12 months. One group that has suffered the most from this lack of face-to-face interaction is the younger members of the community, who regularly tell us that they really feel they’ve been missing out – whether that’s observing how their boss handles a difficult situation or going for that drink after work at their favourite hostelry in Lime Street! Let’s also not forget those international trips, which are an essential activity for us to develop new business and new relationships, as well as to service long-standing business partnerships.

Results from the LMForums Technology & Innovation Leaders Practice Group - March 2021

While we sit tight and wait for restrictions to ease, at LMForums we’re doing everything in our power to help members stay connected—so it’s been a busy period for us. Our goal is always to help those we work with learn from each other, and we’ve seen a big increase in the number of people getting involved in sessions—not only those based in London, but those from international insurance hubs around the world such as the US, Australia and parts of Asia. It’s been a real concerted effort from all involved to keep the information and learning flowing, and it has been really exciting to see. Equally, we’ve seen a big uptake in interest from the vendor and partner community, on which the London Market is heavily reliant. With most conferences and seminars non-existent these days, for many, LMForums has proven to be a valuable link to the community they call their “second home”.

LMForums is committed to continuing to provide an open platform, free at the point of access, for all insurance professionals—irrespective of where they are in the world. When we return to EC3, we intend to take all that we’ve learned over the last year and operate in a hybrid style format, that enables our events to run in both a face-to-face format, as well as via video link —keeping this international link alive as well as including those still working from home.

We’re looking forward to seeing our international partners again soon. Photo by Gil Ribeiro on Unsplash.com

One of the key and persistent “takeaways” from the many LMForums sessions over the last few months has been the adoption by most Market firms of new technologies, platforms and processes. The pandemic has, beyond a doubt, escalated the roll out of these systems and new ways of working and Boards of Directors are now showing more interest in technology than ever before. Hopefully these changes over the last year will mean the ‘new normal’ will see us spending more time with clients and less time filling in the staple London Market product, the “Excel spreadsheet”.

If you're not already a member of LMForums, I really can’t underline enough how useful it is to be part of this fast-growing hub full of potential new connections. And if you’re a vendor or subject expert looking to grow your network, then there’s also no better place than here.

I look forward to seeing and hearing from you over the next few months, and watching how EC3—and the global Market remerges from this elongated period of domiciliary hibernation. In the meantime, do stay safe!

Roger A. Oldham - Founder & Managing Director at The London Market Forums.

Roger has over 30 years frontline experience in the London and international insurance markets at executive level. He is an experienced and qualified Mediator, having trained with the Chartered Institute of Arbitrators in London. He specialises in insurance disputes on a global basis, but is experienced in handling all forms of commercial dispute.

Roger is also know for founding and running the successful and popular Market networking and educational group, London Market Forums. The group brings thousands of professionals together every year. LMForums is free to access for all insurance professionals and is supported by a select number of quality industry suppliers and advisors. Roger also created the Market People Magazine and is the executive producer behind the very popular Market People Awards.

He is also a leader in operational excellence and business transformation, as well as a qualified coach, mentor and experienced trainer. He has been responsible for driving change in the industry all over the world. He is a regular speaker at industry related conferences about industry change, modernisation and operational improvement and runs two popular professional members' clubs.

During his career, Roger has been responsible for functions and teams at firms such as Aon, HSBC and Marsh. He has led claims teams, multi-region operations and change projects in the Middle East, Far East and North America.

He became one of Aon's leading claims troubleshooters, working with the Chairman's Office, travelling all over the world resolving disputes.