Sustainability and sustainable development are now recognised as being crucial to the health of the planet and its people. The International Institute of Sustainable Development says that development is sustainable if it ‘meets the needs of the present without compromising the ability of future generations to meet their own needs’.

The Circular Economy (CE) as described by the Ellen Macarthur Foundation, represents an alternative to the traditional “linear” economic model of ‘take-make-waste’. CE behaviours are reduce, reuse, recycle and regenerate. These will ensure that the best value is extracted from natural resources while they are in use, keeping these resources in use as long as possible (e.g., through designing for reuse), and then recovering from and regenerating products once they do reach the end of their life.

CE can be imagined as a form of butterfly (Figure 1) representing a two-sided circular model. Circular flows from use to re-use represent the “wings” of the butterfly, with one relating to renewable resources and the other “wing” relating to non-renewables or finite material. The two sides are linked by the butterfly “body” representing a supply chain/transformation process of parts manufacture, completed goods manufacture, and the service provider. CE has really only been considered in relation to goods (e.g., cars, machines) and natural resources (e.g., food and land). System-wide sustainable development can only occur if services, organisations and their people are included in the actions that are needed.

The financial service sector in the UK is important in two ways: it is a significant part of the economy, in terms of employment, revenues and contribution to taxation. The ABI reported that in 2017 the UK insurance sector was the largest in Europe contributing £29.1 billion to the UK economy and employing over 300,000 people. More importantly, it is the means by which the rest of the economy keeps moving and transacting, investing and insuring, and saving for the future.

Financial Services needs to become more sustainable in its approach to innovating its own organisations; but also, in the products and services it offers to its customers and clients to help them become more sustainable. Finance could lead the way in financing and encouraging sustainability and becoming an example to the rest of the economy in encouraging sustainable behaviours.

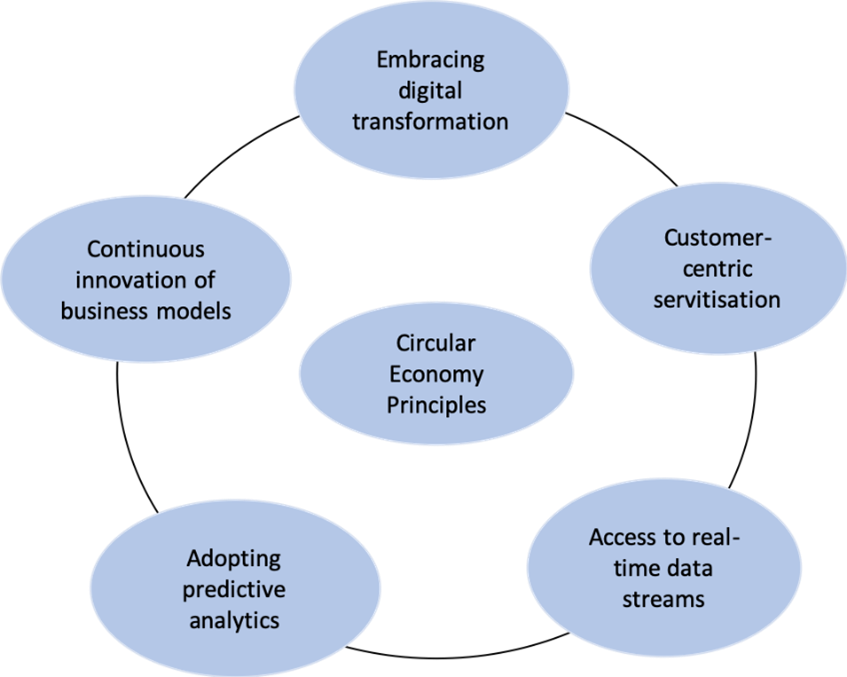

Traditional insurance products mitigate and create significant barriers to the adoption of alternatives. Consider now the concept of Circular Insurance (CI). This represents a potential new insurance ecosystem that could help the insurance sector to thrive in the Digital Economy by using innovative digital technologies to encourage and reward behaviours that embrace and enhance the CE principles.

CI means an insurance company should insure the use of an asset, and price the insurance based on reusable elements in the asset. Its aim is to improve long-term use through improving focus on aligned customer and environmental outcomes and move towards a model that aims to prevent risk and encourage preventative behaviour.

Figure 1 shows the key features of Circular Insurance.

- Data drives all members of the ecosystem embracing digital transformation.

- It is led by the customer with organisations adopting a continuously adapting business model based on customer outcomes not traditional products.

- Real time data ensures relevancy and agility.

- Predictive analytics provides insights into new value propositions and risk reduction.

- CI will lead to change in business models and provides much needed agility to the insurance sector.

CI is driven by data and the technology which facilitates its collection and analysis. Parametric insurance is an example of the beginning of this journey, but there is a need to move through innovative producer offerings to more holistic and customer-focused offerings.

Sustainable development can only occur if services, organisations and their people are considered in conjunction with materials, renewables, and natural resources; financial services, and particularly insurance, will play a key role in helping their own organisations and helping their customers adapt and adopt.

Dr. Phil Godsiff and Dr. Zena Wood are members INDEX, a research and teaching centre that provides practical insights and measurable impact to organisations in the digital economy, part of University of Exeter Business School which also has two significant environmental centres: The Centre for the Circular Economy with close links to the Ellen Macarthur Foundation; and the Land, Environment, Economics and Policy Institute (LEEP). Come and talk to us about our work in these areas.