At COP26 in Glasgow, Rishi Sunak announced that the UK will be the first country to require all financial institutions and listed companies to set out plans on how they will transition to net-zero from 2023. In practice this has translated into an HMT roadmap for mandatory climate risk reporting aligned to the Taskforce for Climate related Financial Disclosures (TCFD) standards. In a change to FCA rules, from 6 April 2022 more than 1,300 of the largest UK-registered companies, LLP’s and financial institutions now have to disclose climate-related financial information on a mandatory baseline line with the TCFD. The UK is the first G20 country to enforce this.

Any firm in the UK insurance market with more than 500 employees falls under these new rules. Whilst the largest insurers have had this obligation since 2021, the next 12 months will see many in the market having to collate and disclose climate risk information in their annual reports, for the first time. The ambition being to minimise Greenwashing (unsubstantiated sustainability claims), and tie ESG statements made by institutions to a recognised framework with traceability, improving investment decisions, reducing risk and contributing to a greener financial economy.

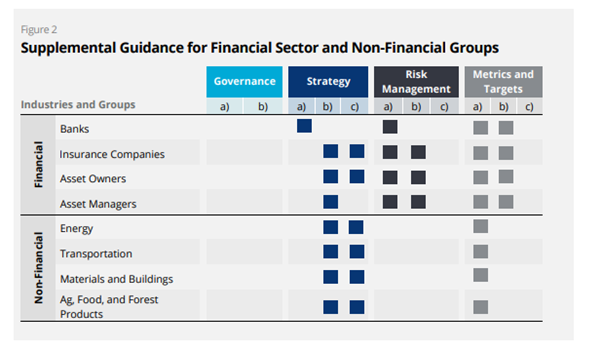

So where to start? TCFD reporting covers Scope 1 (Direct) and Scope 2 (Indirect) Green House Gas (GHG) emissions and climate related risks across 4 main pillars: Governance, Strategy, Risk management, and Metrics and Targets. It is worth noting there is specific guidance for insurers in several of these pillars (see diagram below). For example, “insurance companies should describe key tools or instruments, such as risk models, used to manage climate-related risks in relation to product development and pricing”. They are also required to outline the extent to which their insurance underwriting activities are aligned with a “well below” 2°C temperature rise scenario.

Source: TCFD Implementation Guidance

However, there is already some early analysis from the FCA where UK company reporting is falling short, highlighting areas for improvement. From analysing the 171 responding firms required to file up to April 2022, there shows some greater challenges in aligning to TCFD standards within the 2 pillars of Strategy and Metrics and Targets. This gives a nod to where the regulator will be scrutinising further firms reporting;

- 24% of firms reported inconsistency with TCFD Strategy – especially in relation to resiliency against taking into consideration different climate-related scenarios, including a 2°C or lower scenario

- 19% of firms reported inconsistency with TCFD in relation to their performance against targets.

Based on another comprehensive survey of TCFD participants, 90% of users of disclosure information said reporting of financial impact of climate risk as useful information, but only 20% of disclosure preparers report this information. Although analysis of public company reporting shows that metrics and targets is one of the highest areas of disclosure, the majority of survey respondents found the Metrics and Targets recommendation “somewhat difficult” or “very difficult” to implement. So aligning to TCFD is not without its challenges.

For those firms wanting to know where to focus their efforts in TCFD reporting, and what’s coming over the hill, there are 3 key areas for attention:

- Credible roadmap & target setting - looking to science-based targets for a route to net zero, and complimentary frameworks such as Global Reporting Initiative (GRI) is where best practice starts

- Scope 3 analysis - while Scope 3 (indirect / supplier GHG emissions) is currently out of scope, for the insurance industry this is often where some of the biggest gains towards a net zero target can identified. Many firms are already choosing to disclose Scope 3 voluntarily as a result, but insurers have limited current access to data in this regard (which is also the most complex) as the Bank of England’s recent "CBES" stress test results demonstrated

- Identifying & improving data sources - with traceability at the heart of the TCFD framework, surfacing internal data, reliable external data sourcing and document storage will be key to successful reporting.

So the hill the London Market now has to climb in terms of TCFD is one of traceable reporting and targets aligned to industry standards, supported by an implementation path and the available data sources to report on progress to target. Now that’s a mouthful… but there’s a clear nod to what could be coming over that hill from the regulator and the HMT roadmap – further refinement to the rules in 2023 and 2024.

For those organisations who’ve approached their initial TCFD reporting as a bare minimum of a tick box exercise (and not an opportunity to drive embedded ESG transparency and data), what will be coming over the hill is a regulatory mountain to climb in terms of ESG reporting, also not forgetting de-risking their climate related exposure (measured as Climate Value at Risk) and progress against carbon reduction targets.

Here at CGI our UK sustainability consulting team is undertaking our Global TCFD reporting, including Scope 3 disclosures. We know what London Market firms need to focus on to achieve a right sized approach based on your ESG maturity, and the pitfalls to avoid. Drop me a line if you’d like to talk this through on chantal.constable@cgi.com.

Chantal Constable is Head of Growth for CGI’s Insurance business in the UK & I, where she is also the Sustainability & ESG lead and a member of the leadership team, previously having headed up London Markets. Prior to her Insurance roles at CGI, Chantal ran the Retail and Corporate Banking business in the UK. This encompassed CGI’s payments capability, open banking offerings including overlay services, collections, anti-financial crime applications as well as managed IT services and legacy modernisation delivery. It’s a fascinating time to be in the Insurance and FS market and Chantal is fortunate enough to be invited to industry panels to speak on subject matters such as debt management in the pandemic, cyber security trends and the potential of open finance for the UK financial services market.