Mendix recently surveyed more than 1,200 FSI (financial services and insurance) decision-makers. These leaders answered how they felt about their initial low-code implementations, positive outcomes, and future opportunities.

The resulting white paper, Solutions That Deliver: What Every Insurer Needs To Know About Low-Code, has the full results. This article helps insurers look ahead to 2023 planning and beyond with discussion of a few key numbers and how low-code can enable insurance digitalisation without disrupting core systems.

Insurers agree. Low-code works.

97% of respondents noted that their first implementation met or exceeded their expectations. That’s an eye-opening number and shows that low-code platforms get the job done. That’s not all! Any new platform has natural questions around data, security, and deployments. Low-code providers (like Mendix) are meeting those concerns and enabling insurers to build the solutions they need.

Cost savings and long-lasting benefits

When starting with a low-code platform, insurers generally have a specific business challenge they’re looking to solve, and that makes sense. Traditionally, insurers buy many single-point solutions from lots of different vendors. Mendix offers development templates designed to kickstart the process and deployment quickly, and insurers are finding value far beyond that initial solution.

The headline grabbers are ease of platform use, faster time to market, and cost savings. More importantly, insurers are also finding success in integrating low-code with their core platforms and even enabling citizen development. The possibilities extend far beyond that first solution.

Erie Insurance is one of the leading insurance providers in the United States. The enterprise recently realised a need for customer-facing native iOS and Android apps. However, Erie doesn’t employ any mobile-specific developers. Having already utilised the Mendix platform for a commercial insurance agent portal, Erie felt comfortable building their solution with Mendix. They quickly deployed a stunning application using their existing development team, complete with key features like biometrics and downloadable IDs.

Faster time to market: Not just a promise

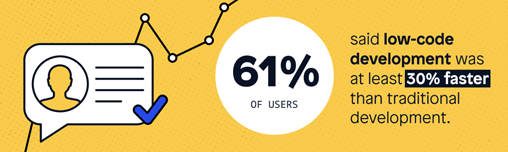

Insurers see a lot of buzzwords when considering software vendors and solutions. Every platform claims to be fast and efficient. However, the performance doesn’t always meet the promise. Survey respondents say low-code platform claims about speed aren’t just for show.

Low-code platforms help insurers deliver faster, with most respondents seeing speed gains of at least 30%. That means more projects getting completed, more headspace for IT teams, and more room for innovation.

Use cases across the enterprise

Think of a use case; chances are that low-code can help deliver a custom solution easier and faster than traditional development. The survey results back that up, with insurers finding successes in many different areas of the enterprise, including but not limited to IT, sales, and claims management.

That’s excellent news. It also raises the critical question of where to start. Every project can feel mission-critical with aging core systems and needs across the industry. The crucial step is to get started and get that first success. That’s where Mendix can help enable success. To make that more tangible, look at the story of Zurich Insurance. Zurich used the Mendix platform to quickly build and deploy solutions to strengthen policy administration and external customer experience. These solutions helped Zurich cut costs and increase revenue.

The key to insurers’ digital transformation

These numbers show some of the critical benefits insurers are seeing from low-code. Download a copy of Solutions That Deliver today to get the complete picture. With Gartner predicting that 70% of new applications will be built on low-code/no-code platforms by 2025, insurers simply can’t afford not to have all the information. Stay tuned for our next blog to learn how Mendix is partnering with ecosystem partners to help insurers jumpstart their low-code journey. The path to digital transformation is firmly in view.

With more than 20 years’ management experience within the insurance, financial and blue-chip sectors; Paul has built a strong reputation for introducing business change and Customer Experience strategies that expand operations and drive exceptional growth across US, UK and EMEA markets.

Throughout his career Paul has managed large profit centres, led senior leadership teams in the execution of business transformation initiatives and introduced rigorous performance metrics to drive a culture of service excellence and customer focus, across international operations.

Creating a cohesive and streamlined approach to improving the Customer Journeys and operational performance of global businesses are some of Paul's' greatest strengths. He designs Target Operating Models and launches new sales and service operations in both mature and emerging markets.

Delivering business solutions that improve the operational capability of organisations is my speciality. Paul has an innate ability to simplify complex ideas and devise growth strategies that can be implemented efficiently and easily, achieving buy-in and outstanding financial results.

09102023.png)

.png)